As the age-old adage goes, if there's money to be made, someone will make it. This is the undercurrent of the entrepreneurial spirit and the reason why capitalism exists. Some would claim that it is human nature to capitalize upon opportunities. Arbitrage was born of this human urge to take advantage of money-making opportunities.

What is arbitrage?

The definition of arbitrage is a bit arbitrary, if you will. On a general level, the term means finding and taking advantage of price discrepancies among or within markets to make money. There are, however, cases this label applies to, but that experts and academics say are not “true” arbitrage.

For example, if you found a stock that you believed was incorrectly priced based on the company’s financial information, you could take advantage of this knowledge to try and make money. However, this is not a case of true arbitrage, despite the application of our general definition.

So, what constitutes “true” arbitrage?

There are three conditions under which arbitrage can occur, and as you will see, none of them apply to this example.

- The same asset doesn’t have the same price in all markets, also known as the law of one price.

- Two assets with identical cash flows, balance sheets, etc., do not trade at the same price.

- An asset with a future price doesn’t trade today at the future price discounted at the risk-free interest rate. Exceptions to this could occur if the asset has high storage prices—think grains, oil, or metals. If the concept of future price discounting confuses you, let me explain further. The risk-free interest rate is a theoretical rate that you would earn if you invested your money in an absolutely risk-free investment. This is usually a bond or government-backed security with almost zero chance of default. So, if you buy a $1,000 1-year government bond with a (risk-free) interest rate of 5%, you should expect to receive $1,050 in a year. So in this situation, the future price ($1,050) is the same as the present price when it is discounted by the interest rate. If an asset didn’t trade at the same price in the future and today (when discounted), it would indicate that there were either inefficiencies in the market, or that people believed that the price would increase or decrease in the future. Both of these situations present an opportunity to make money, so arbitrage can occur.

Now, you may be thinking to yourself that all these situations seem highly improbable—after all, you can compare prices for assets or items on a plethora of different websites and exchanges. True arbitrage was much easier to find and thereby more common before the internet and the instantaneous exchange of information that came with it. With today’s rapidly moving financial markets, the thought of 2 identical bonds, for example, being sold for different prices is unthinkable. Financial firms have complex algorithms to detect and capitalize upon any disparities in the market or prices. The rise of high-frequency trading has added a great deal of liquidity to the market, such that any abnormal price drop would disappear in milliseconds.

Defining "true" arbitrage

The example I used above about a mispriced stock is what we would refer to as risk arbitrage. Most of the arbitrage seen today is of this type—detecting “mispricing” based on company fundamentals and educated guesses towards future market performance.

True arbitrage requires that there must be no risk in the transaction. For this reason, buying an iPhone inexpensively in America and selling it for a profit in China, like some savvy iPhone 6 buyers did, is not true arbitrage. The jubilant iPhone buyer below (captured by Getty Images) may think he is cleverly practicing arbitrage, but the rules of what constitutes such tell us otherwise.

The most ideal example of risk-free arbitrage would be buying a security on one exchange and simultaneously selling it on the other for a profit. Even so, milliseconds of lag can lead to a loss of money. The risk created by differences in transaction times is sometimes called execution risk.

At this point, you’re probably thinking that all these conditions on what is “true” arbitrage and what isn’t are super restrictive and probably never met. Again, you are correct—these definitions and explanations are largely theoretical. In your life, you will hear the phrase arbitrage used to describe any time money can be made via mispricings or clever anticipation of future trends. The financial concept of arbitrage is just a lot more complex, so just keep the distinction in mind.

Arbitrage goes global

One important application of arbitrage arises when we consider exchange rates and multi-national corporations. Lets say that you live in Germany, where interest rates are low. If you borrow money at a 1% interest rate in Germany and invest the money in a Brazilian bank account with a 5% interest rate, you will obviously make money. If you are a very wise person and buy a forward contract¹ that ensures you will receive the same interest rate when you convert your money back from Brazilian pesos to German euros, you are practicing covered interest arbitrage. Investors who are covered (or protected) from foreign exchange risk are practicing risk-free arbitrage.

The disparities between the interest rates of assets or prices of goods in different countries are positive for those trying to make money, but negative for multi-national corporates and global consumer welfare. The wonderfully idealistic condition under which interest rates (or whatever) for assets in different countries are identical once exchange rates are factored in is known as interest rate parity. Interest rate parity is a zero-arbitrage condition, meaning, when it applies there is no opportunity to make money due to price differences—they don’t exist.

How does arbitrage impact the world?

The most wonderful result of arbitrage (and the corresponding entrepreneurial folks trying to take advantage of money-making opportunities) is the global price convergence that it causes. Arbitrage ensures that prices remain consistent across markets and helps them do so globally. How quickly markets correct or recognize mispricings is resultantly a measure of market efficiency—a very efficient market like America’s NYSE would correct a stock mispricing instantaneously, but smaller stock exchanges might not do so as quickly. The opportunistic search for ways to make money off of market mistakes ends up driving prices and rates much closer to their true valuations, benefitting us all.

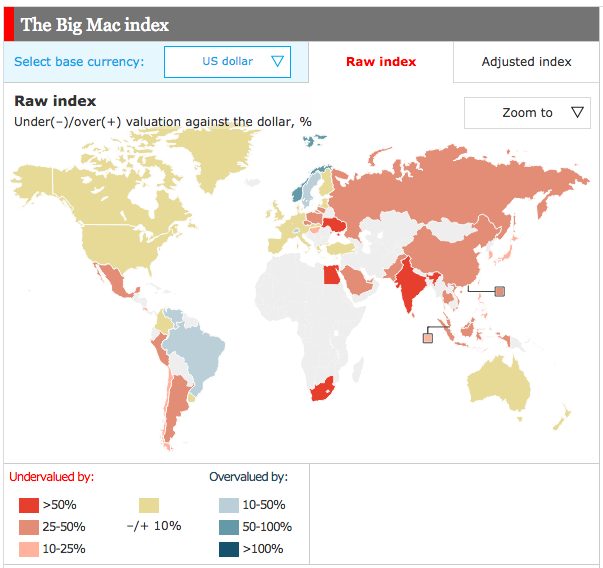

An interesting measure of price convergence and interest rates globally is known as purchasing power parity. Purchasing power parity, or PPP, examines the cost of a bundle of goods or a good in different countries to determine if interest rates are accurate and prices similar. PPP thus serves as a measure of both consumer welfare and purchasing power. The best and most fun example of PPP is the Big Mac index, which as the name implies examines the prices of Big Macs all over the world.

“The Big Mac index was invented by The Economist in 1986 as a lighthearted guide to whether currencies are at their “correct” level. It is based on the theory of purchasing-power parity (PPP), the notion that in the long run exchange rates should move towards the rate that would equalise the prices of an identical basket of goods and services (in this case, a burger) in any two countries.“ - The Economist

Image part of The Economist's Big Mac index

Arbitrage and you

If you work in corporate finance, international business, or bank's foreign exchange division, some form of the concepts discussed above will likely come up. Understanding and being able to account for interest rate and other risk is critical to running a successful multi-national business or doing business with international partners. Even international eBay sellers would be wise to consider interest rate implications of their transactions. If you only remember one thing from this article, remember the world "arbitrage" so that you can sound fancy when people describe their opportunistic ventures.

Further Reading:

Most writings on the topic of arbitrage are either extremely simplistic definitions or complex theoretical papers, so finding a medium ground can be hard. If you want to learn more, the Wikipedia pages for arbitrage, interest rate parity, or purchasing power parity are your best bets.

¹For those unfamiliar, a forward contract can be customized for nearly any security, currency, or whatever to ensure a locked-in price of exchange in the future. Foreign exchange risk among highly developed currencies is fairly low, but if a multi-national company had employees on payroll in another country, they would want to ensure that at pay day they weren’t forced to pay an exchange rate that had increased by .005%. The small percentage doesn’t seem like a lot, but when applied to millions of dollars could have a large impact. Thus, multi-national companies and business people might buy forward contracts to ensure they will be able to fulfill commitments at a given price.

Money represents a social agreement, which has implications for how we value wealthy people. Bitcoin replaces the need for this social agreement with technology, and in doing so challenges the values we ascribe to wealth.